How To Do A Zero Based Budget And Why They Work

Have you ever heard the term, Zero Based Budget? Do you know what it is or how it works? Don’t let the word “budget” scare you. Budgets aren’t restrictive or depriving. A budget is simply, a plan for your money. It tells your money where to go and makes your money work for you instead of disappearing.

What I have found over the years is that the people who state that budgets don’t work are the ones who have not really taken the time to put one down on paper with purpose. A budget won’t work if it’s vague or if you only do it once and give up because your finances change monthly. That’s why it’s so important to do one at the beginning of every single month.

Furthermore, a budget is not intended to steal your joy and take all the fun out of life. Quite the contrary. A budget will take the stress and pressure off of you that is caused from not having a plan for your money. It takes all the guesswork out of what to do with your money and replaces it with a good solid plan.

If you’re afraid to do a budget because you’re scared of what you might find, get over it.

Are you overspending every month (meaning going in the hole)? Doing nothing is the worst thing you can do and ignoring that fact only makes things worse.

Do you have money left over every month? That’s great if you do, but could you put it to better use? If you answered yes to any of these questions, then the zero based budget is exactly what you need.

*This post may contain affiliate links, which means that if you buy a suggested product, I will earn a small commission, at no extra cost to you. For more information, see my disclosure page.

What is a Zero Based Budget?

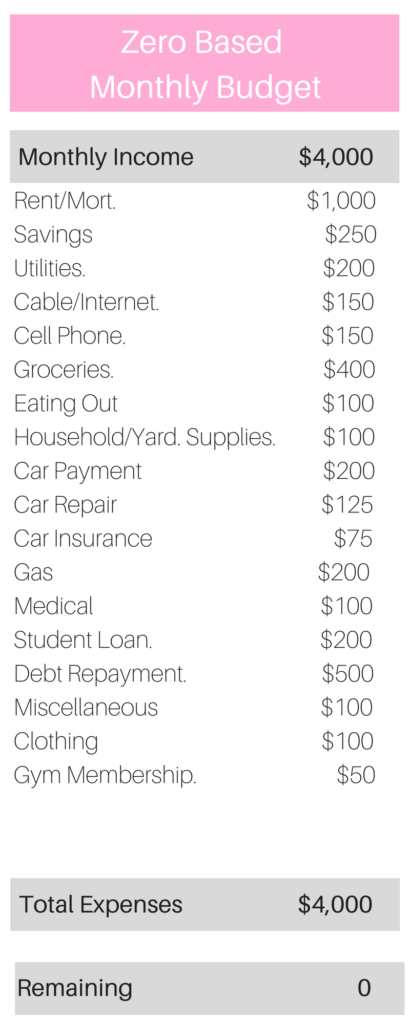

Simply put, a zero based budget is where you make the income minus the outgo equal to zero. Don’t let the word “zero” scare you. Each month, your goal is to plan how to spend your money. You want to end up (on paper) with zero.

This is what it would look like: Income – Expenses = zero

How Does a Zero Based Budget Work?

The first thing you will need to do is add up ALL of your projected income for the month. That means everything. Any money you receive, whether it’s your regular paycheck, child support, side gigs, literally anything and everything. Put it down on paper at the top of the page.

Next, list out ALL of your expenses. This even includes savings. Make sure to include eating out, spending money, cigarettes, anything you will spend money on. Remember, you are deciding right now what you are spending your money on and how you are spending it.

Subtract all the expenses from all the income and if it comes out to zero, great! But if you have money left over, then you’re not done! You must decide how that overrage will be spend. Will you put it towards debt or savings? DO NOT leave this money unaccounted for. Put it where you will see the most benefit.

Example of a Zero Based Budget

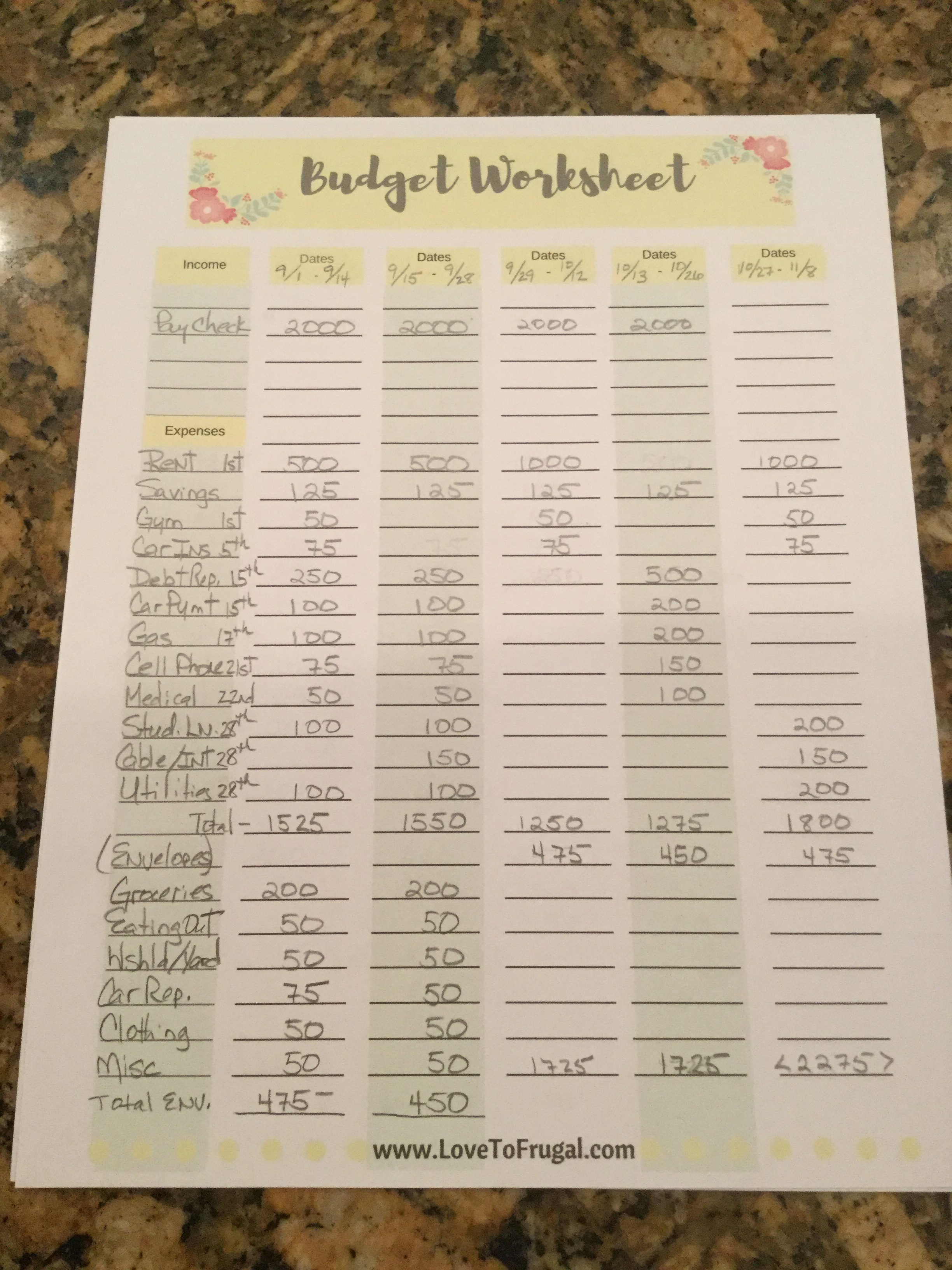

Budget Monthly or By paycheck?

Below is an example of a biweekly pay schedule. For the month of September, it shows how to break the paycheck down by splitting some or most of the expenses in half, thereby not having so much coming out of a single check. (Notice that I put the expense in chronological order by due dates). The expenses at the bottom are the variable expenses that you can use envelope system with. The amount at the bottom is what you’d need to pull out for cash, every two weeks.

The first two columns “zero out” perfectly with a $2000 net paycheck. When you add up all of the expenses and subtract them from the pay, you have zero left.

The second two columns show what happens when you put the expenses total amount in the column where the due date would fall. It looks as if you would have money left over in this scenario, for each check, but when you look at the paycheck on 10/27 and you add up your total expenses, you will fall $275 dollars short, that pay period. You would need to reserve money from the previous checks to be able to have enough to pay the bills that are due for that period.

RELATED POST: How To Use The Half Payment Method

What if you don’t have any money left and you are in the negative? Well, you need to start cutting some things from your budget.

Where Can You Cut?

There are five areas that I recommend looking at first:

Eating out

This is a major area where many people spend too much. Keep track of this and you may get quite a shock! Learn to cook, eat leftovers, take your lunch, stay out of restaurants or fast food places. For what most people spend on eating out, you could feed a family of 4 or 5 for a month or more!

Car payments

Here’s another area where people spend way too much! That $500-$600 car payment may be keeping you from your goals and dreams. A car is one of the largest purchases you can make, next to your home, that goes down in value as soon as you drive it off the car lot. Vehicles lose 60% of their value, in the first 4 years. If you can, pay cash and buy used. No one really cares how good you look at a stop light. You can find a good reliable used car for way less. Let someone else eat the depreciation!

Utilities

Utilities are a great place to cut expenses. Bump your air up to 78 and use your fans. One of my favorite ways to save money in this area is line drying my clothes. I do this several times a week, if the weather is good. They dry faster and smell great! Unplug whatever you can and make sure to turn lights off when you leave a room. These are just a few ways to save, but they can have quite an impact.

Clothing

How much clothing do we really need? I like to shop our local thrift store when I have the urge to buy. I am a girl, after all and I love new clothes, like anyone else, but I like to see what I can find there before I shop retail. Ive been able to find some of the cutest things for a fraction of the department store price and sometimes, they’re even new, with tags still on them. And I do have to say, I look just as stylish as anyone else. I look for quality and style. If it doesn’t fit right or look great on me, I don’t buy it, no matter how inexpensive. If you haven’t been to a thrift store lately, you don’t know what your missing! For $20, you can leave with several nice pieces of clothing.

Groceries

Food is probably the biggest area that you can cut in your budget. I looked up the numbers for the average cost of a family of 3. In my house, it’s me, my husband and a grown son. For the “thrifty plan”, it’s $465, Low Cost is $600, Moderate is $731 and the Liberal plan is $911. Well, I can tell you that by using meal planning, store coupons, buying store brands and cutting out the processed foods, I spend just under $400 a month and we eat very well and we eat healthy. This includes toiletries as well as food. Start keeping track of your receipts for a month and add them up to get an idea of what you’re actually spending. You might get a shock! But this is easy to remedy.

Why Does Zero Based Budgeting Work?

Zero based budgeting works because it eliminates overspending. Having a plan for your money means you are being intentional with it. You are able to prioritize your expenses with a budget, thereby giving you a clear picture of the most important expenses that need to be paid and it keeps you from spending all of your money on less important things. The best part about it is you get to decide how to spend your money, intentionally. If you want to go out to eat once or twice a month, plan for it and put it in the budget. This will eliminate any guilt you might have about doing so. If there isn’t enough money in the budget this month for eating out, you don’t go.

How to Get The Most out of a Zero Based Budget

In order to maximize the benefits of zero based budgeting, give yourself some time to get it right because a budget usually never works out the first time (or month) it’s done. It takes a little practice. It’s important to sit down and do this before the month begins.

Get out your past 1-2 bank statements or your check register, if you keep one, and look at ALL of your expenses and where you are spending money. Write everything down so you know your categories and be realistic about what your spending so you don’t underfund your categories (or overfund them).

In order to get an accurate picture, you’re going to need to track your expenses for at least one month. Doing this will give you a good idea on how to fund each category.

You will find that you will have expenses that don’t occur every month and you need to account for these as well. This is why it’s so important to do a budget every single month. You might find it easier take some of these occasional expenses and go ahead and take a portion out of each paycheck until it’s due. This would be like having a sinking fund for them. Read more about them by clicking the link.

Make sure to set a little extra money aside, if you can, for miscellaneous expenses. We all have those come up every month, so I take out some cash for that and only touch it when I have to. Main thing is, it’s in the budget!

Is Saving or Investing Part of the Budget?

Well, sort of. Your monthly income is what’s going to build wealth and you need a budget for your monthly income in order to build wealth. Without one, your income will disappear. If one of your goals is getting out of debt, put it in the budget. If you want to contribute to an IRA or your savings/emergency fund, put it in the budget. This goes for literally anything…even kids’ college.

What Works Best?

The question is pencil/paper or electronic. This is definitely a personal preference. The answer to this question is which ever one that will help you stick to it. Personally, I’m old school. I prefer to put it down on paper. I’ve been doing it this way for so long, that it just come naturally. But there are so many wonderful apps out there that make budgeting so much easier. I have used Dave Ramsey’s Every Dollar and I have no complaints, at all, other than when you make your budget, it’s for the whole month. You will have to decide what works best for you.

Let’s Try It!

The zero-based budget seems pretty simple, right? That’s kind of the whole point! The idea behind it is to show those who have trouble balancing their checkbook a way to visually hold themselves accountable. This is a tool for people who want to establish a reliable, cost-cutting routine each month. The fact that you must sit down and re-create it every few weeks allows you to establish a pattern and keep careful track of your spending patterns. And, once you’ve got it down to a science, you can either continue to use it or switch to something that allows a little more freedom.

If you’ve never done a budget before or you’ve tried and failed, don’t give up! This the best budgeting method that I have ever tried and I keep doing it because it works. Most budgets fail because they are to broad and vague. If you set limits on your spending, hold yourself accountable and stay within those limits, you will succeed! Don’t spend more that you make. Period.

Being intentional is the key. You will feel like you’ve gotten a raise when you plan your spending and tell your money where to go and in reality, you will find that you will have more money to do with what you need to, so give it a try and see if it works for you!

Have you tried and failed at budgeting before? Let me know if you plan to try zero based budgeting and if you think it will work for you!

PS…Be sure to subscribe to Love To Frugal so you don’t miss a post! You can also follow me on Pinterest, Facebook and Instagram for even more money saving tips!