Differences Between Roth and Traditional IRAs

When it comes to saving for retirement, one of the biggest decisions you can make is choosing between a Roth IRA and a traditional IRA. It can be very confusing when trying to compare the two. Both of these types of accounts offer tax-advantaged savings, but there are some key differences that can make one option better for your specific financial situation. In this blog post, I’ll explore the similarities and differences between Roth IRAs and traditional IRAs to see if I can help you make an informed decision.

Before we get started, I would like to say that I am not a financial planner. I’ve just done my homework by fleshing out the similarities and the differences. We have consulted with our own financial planner, over the years and have learned what has (and hasn’t) worked for our own retirement planning. I always suggest that everyone else do the same. Everyone has a different financial picture and what works for one may not be the best option for another.

*This post may contain affiliate links, which means that if you buy a suggested product, I will earn a small commission, at no extra cost to you. For more information, see my disclosure page.

What is a Traditional IRA?

A traditional IRA is a type of individual retirement account that allows you to make tax-deductible contributions up to a certain amount each year. The money in your account grows tax-deferred. This means you won’t pay taxes on your earnings until you withdraw them in retirement. Once you reach age 59 ½, you can start making penalty-free withdrawals. You must start taking required minimum distributions (RMDs) by age 72.

What is a Roth IRA?

A Roth IRA is another type of individual retirement account. This one allows you to make after-tax contributions up to a certain amount each year. Unlike traditional IRAs, the money in your account grows tax-free. This means you won’t pay any taxes on your earnings when you withdraw them in retirement. You can also make penalty-free withdrawals of your contributions at any time, but you must wait until age 59 ½ to withdraw any earnings tax-free.

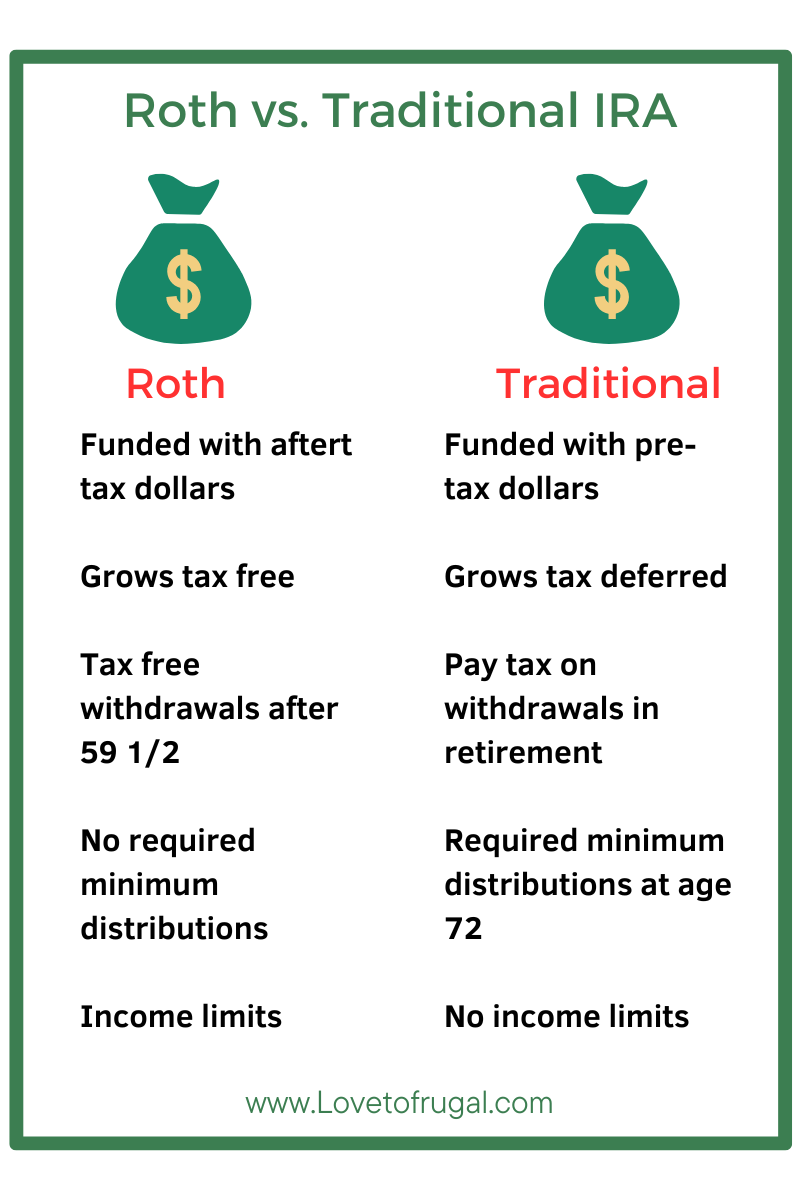

Roth IRAs vs. Traditional IRAs: Key Differences

Tax Treatment

The main difference between Roth IRAs and traditional IRAs is how they’re taxed. With a traditional IRA, you get a tax deduction for your contributions in the year you make them. You will, however, pay taxes on your withdrawals in retirement.

With a Roth IRA, you don’t get a tax deduction for your contributions, but your withdrawals in retirement are tax-free.

Income Limits

There are no income limits for Traditional IRAs, however there are income limits for tax deductible contributions.

There are income limits for Roth IRAs. For 2023, as a single filer, you can make a full contribution to your Roth IRA if your modified adjusted gross income is less than $138,000. A partial contribution is allowed for 2023 if your modified adjusted gross income is more than $138,000 but less than $153,000. If you are married and filing jointly, you can make a full contribution to a Roth IRA if your modified adjusted gross income is less than $218,000 in 2023. A partial contribution is allowed if your modified adjusted gross income is more than $218,000 but less than $228,000.

Required Minimum Distributions

With a traditional IRA, you must start taking required minimum distributions (RMDs) by age 72, even if you don’t need the money. This can be a disadvantage if you want to keep your money invested and growing tax-deferred.

With a Roth IRA, there are no required minimum distributions. In other words, you can let your money continue to grow tax-free for as long as you want and as long as you have an earned income.

Penalty-Free Withdrawals

With a traditional IRA, you’ll pay a 10% penalty if you withdraw money before age 59 ½, with a few exceptions.

To qualify for tax-free withdrawals from a Roth IRA, you generally need to hold the account for at least five years and be 59 1/2 or older. This means that the money you contribute to a Roth IRA, as well as any earnings or gains, can be withdrawn tax-free once you meet both of these requirements.

There are some exceptions to this rule, however. For example, if you become disabled, the five-year holding period may be waived, and you may be able to withdraw funds from your Roth IRA tax-free before age 59 1/2. Additionally, if you use the funds for certain qualified expenses, such as a first-time home purchase or higher education expenses, you may also be able to withdraw funds before age 59 1/2 without incurring taxes or penalties.

It’s important to note that if you withdraw funds from a Roth IRA before the five-year holding period has elapsed or before age 59 1/2 (unless you meet one of the exceptions), you may be subject to taxes and penalties on the earnings or gains withdrawn.

what are the pros and cons of each type of ira

Roth IRAs and traditional IRAs each have their own advantages and disadvantages, depending on your individual financial situation. Here are some of the pros and cons of each type of IRA:

Pros of Roth IRAs:

- Tax-free withdrawals With a Roth IRA, you won’t pay any taxes on your withdrawals in retirement. This can be a significant advantage if you expect to be in a higher tax bracket in retirement.

- No required minimum distributions With a Roth IRA, you’re not required to take distributions at any age. This can give you more flexibility in retirement.

- Penalty-free withdrawals of contributions With a Roth IRA, you can withdraw your contributions penalty-free at any time. This makes it a good option if you need the flexibility. The only caveat is you will pay taxes if you withdraw the money before age 59 1/2.

- You can keep contributing to a Roth, even in retirement There is no minimum income requirement to contribute to a Roth IRA. This is true, regardless of your age or whether you’re retired or not. In fact, you can contribute to a Roth IRA as long as you have earned income from a job or self-employment, even if you’re over age 70 1/2.

Cons of Roth IRAs:

- No immediate tax break With a Roth IRA, you don’t get a tax deduction for your contributions. You’ll be paying taxes on that money now.

- Income limits If you make too much money, you may not be eligible to contribute to a Roth IRA. To contribute to a Roth IRA, single tax filers must have a modified adjusted gross income (MAGI) of less than $153,000 in 2023. If married and filing jointly, your joint MAGI must be under $228,000 in 2023.

- Limited contribution amounts In 2023, you can only contribute up to $6,500 per year to a Roth IRA. If you’re over 50, you can contribute $7,500.

Pros of Traditional IRAs:

- Tax-deductible contributions. With a traditional IRA, you get a tax deduction for your contributions. This can lower your taxable income now.

- No income limitations. Unlike a Roth IRA, there are no income limitations on who can contribute to a traditional IRA, making it an option for high earners who may not be eligible for a Roth IRA.

- Access to a wider range of investments. With a traditional IRA, you may have access to a wider range of investment options.

Cons of Traditional IRAs:

- Taxes on withdrawals. With a traditional IRA, you’ll pay taxes on your withdrawals in retirement. This can significantly eat into your retirement savings.

- Required minimum distributions. With a traditional IRA, you’re required to take distributions starting at age 72. This can be a disadvantage if you want to keep your money invested and growing tax-deferred for as long as possible.

- No penalty-free withdrawals of contributions. With a traditional IRA, you’ll pay a 10% penalty if you withdraw money before age 59 ½. There are a few exceptions like using IRA funds to pay your medical insurance premium after a job loss.

- Limited contribution amounts. Traditional IRAs have annual contribution limits that may be lower than what you would like to save for retirement. In 2023, you can contribute up to $6,500 per year to a traditional IRA ($7,500 if you’re 50 or older. (Same as the Roth)

- No flexibility with taxes. With a traditional IRA, you cannot choose to pay taxes on the contributions upfront in exchange for tax-free withdrawals in retirement like you can with a Roth IRA.

Which ira is Right for You?

Deciding between a Roth IRAs and a traditional IRAs depends on your individual financial situation. If you’re in a higher tax bracket now and expect to be in a lower tax bracket in retirement, a traditional IRA may be the better option. On the other hand, if you’re in a lower tax bracket now and expect to be in a higher tax bracket in retirement, a Roth IRA may be the better option.

Another factor to consider is whether you need access to your money before retirement. With a Roth IRA, you can withdraw your contributions penalty-free at any time. This makes it a good option if you need flexibility.

Where can i start an ira?

You can start an IRA at a variety of financial institutions. These may include banks, brokerage firms, credit unions, and mutual fund companies. Many of these institutions offer online account opening and management, making it easy to set up and maintain your IRA.

It’s important to shop around and compare different institutions and their offerings to find the best IRA for your individual financial goals and needs. Consider factors such as fees, investment options, customer service, and convenience when choosing where to open your IRA.

You can also work with a financial advisor to help you select and open an IRA. They can provide guidance on choosing the right type of IRA and investment options based on your individual financial situation and goals.

Overall, I hope you have a better understanding of the differences between a Roth and a traditional IRA, now. The decision of whether to choose a Roth IRA or a traditional IRA depends on your individual financial situation. This would include your current tax bracket, your expected tax bracket in retirement and your need for flexibility. It’s important to speak with a financial advisor to determine which option is best for you.

other posts you may be interested in:

How Does A Homemaker Plan For Retirement?

Estate Planning Basics For All Ages

Easy Ways To Improve Your Finances

Be sure to subscribe to my monthly/semi monthly newsletter so you don’t miss a post! I would also love for you join our Love To Frugal community by following me on Pinterest, Instagram and Facebook for more money saving tips!